A look at the gHash.io Mining Pool

Please note: This review is based on a relatively small amount of hashing, a few hundred ghs. The stats outlined in this review may not apply to larger miners. We hacked our antminer S1’s to mine nine pools concurrently, letting us run proportional power across a wide variety of mining pools. This review is part of our series of bitcoin mining pool reviews.

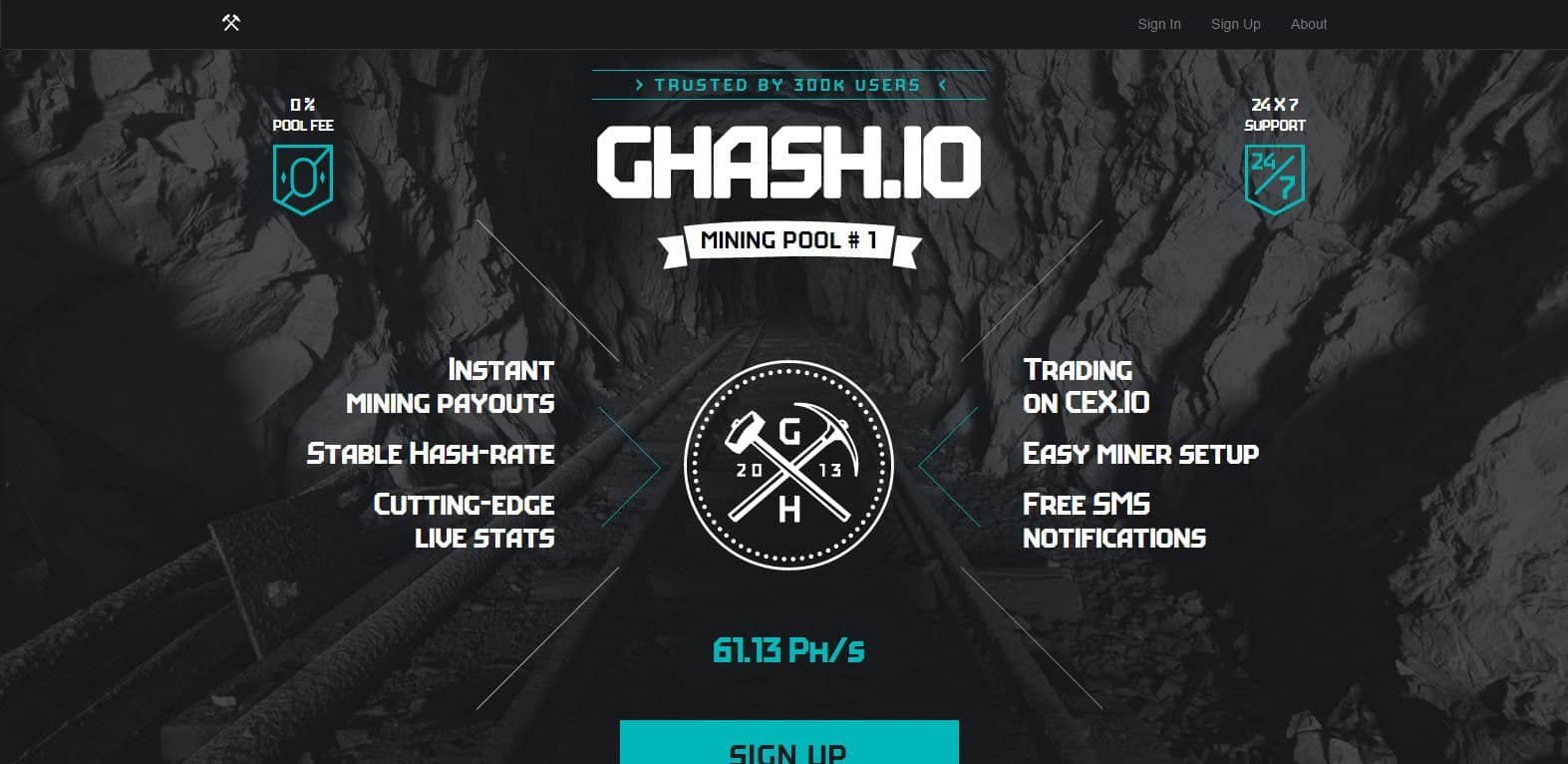

gHash.io are one of the largest mining pools at the moment, after dominating much of the year and approaching the 51% threshold over the summer. Their market share has diminished somewhat to around 22%, but they remain one of the dominant publicly available pools these days. They are based in the UK but they also have US servers and operate using a Pay Per Last N Shares (PPLNS) reward system and a 0% pool fee.

gHash.io and CEX.io use shared login, and if you are buying cloud hashing power with CEX, you will be mining automatically on the ghash.io pool, with associated maintenance fees. However, for the purpose of this review, we’ll be looking at how they fare when you point your own miners at them. They support a wide range of coins, with bitcoin also mining NMC, DVC and IXC. NMC and DVC can be traded on CEX for bitcoin, but IXC can’t. The pool also supports a wide range of Scrypt altcoins, with litecoin and dogecoin being the two most prominent. At the time of publication, they have over 62 petahashes mining.

ghash.io’s interface is straightforward and relatively simplistic compared to other pools, and especially considering how sophisticated CEX looks. It gives you shift information, mining speed information, recent blocks found. While it’s grand on desktop, I tried using it on my Samsung Galazxy S3 and found it very difficult to use the site, as you can’t use the menus properly. Also, all of the options for ghash.io are buried within CEX and not even directly from the pool, so it’s only today when taking screenshots I even found out about the what you can do there.

It features graphs for worker speeds with bars showing you stale shares submitted. It also contains a lot of their latest blocks, and earnings from eligible work in the shift are credited after six network confirmations. It also uses vardiff, so will adjust based on your hashing power. Shifts are broken into 10 minutes, and it has happened on a good few occasions where they didn’t get blocks for ages, so there was a lot of lost work. They do have a tendency to get runs of luck and it’s not unusual to see them hit three, four or more in a row. However, as we’re mining with the same amount of power on different pools, the earnings are actually quite low.

Whether this is because of their shift system, or whether it’s because they have such a huge amount of power that you need a decent chunk of power (ie tens of terrahashes) to get decent earnings, I’m not sure. But in my spreadsheets, they consistently underperformed in return when compared to pretty everyone else out of the eight pools we’re testing in this series of reviews. However, they do respond quickly to support, and the trading platform features a chat room.

Earnings are all handled by CEX.io, and here you can set auto payouts of 0.01. A workaround for getting smaller balances out is to lodge some funds to your account, so it’s over 0.01 and then withdraw. I know the two are interlinked, but it’s a bit of a hard sell and is very disjointed moving from one system to the other. Other than a few help and info pages, the pool is actually quite lacking in much of the information you’d expect, although quite a lot of information is available on CEX. There, you get email alerts when there’s a login, and while you can’t lock a address for earnings, there is optional two factor authentication. There are also notifications if your hashing power drops. The pool also features free SMS notifications if you put your number in.

So in conclusion, I have been very disappointed with gHash.io. You’re forced to use their trading platform, and with everything so disjointed, I feel they’d be better either finishing out the pool side, or just fully integrating it in CEX. They do find a lot of blocks, but I found that they were on the low end of returns, with smaller pools like Eligius and BTC Guild giving way more payout for the same power, even when finding a fraction of the blocks. So I’m quite hesitant to give them a recommendation and don’t have intentions of pointing my own power at them again after doing a thorough comparison between them and the other seven pools I’ve looked at. And if you have a small miner, you’re better off going elsewhere as it’ll take forever to reach their minimum threshold mining with a fixed amount of power.

– Note on cloud purchased hashes

I will separately talk about my experience buying and using cloud mining hashes on CEX.io, which mine on gHash.io.

I bought 22 ghashes which have been mining steadily. Every difficulty change, the value of these drops. So if you don’t sell them before this, and rebuy more, earnings will be very difficult. There is an opportunity to play the markets, and through smart trading build these up over time, but it really feels like a false economy. There are very high fees for the cloud hashes, in addition to what you have paid for them, and it really feels like three steps forward, and two steps back if you are exclusively mining. So it’s difficult to quantify ghash.io without CEX. They’re interlinked tightly, and it does feel a lot like the pool is to draw you into the exchange the way it’s presented, but even with all of that, it really seems like a false economy for me mining on expensive Irish electricity and only a few antminers. But if you want to see the law of diminishing returns in action, it’s a good way to see it.