May 2018 update – Coinfloor continues to be one of the leading GBP bitcoin exchanges, and since this review has expanded to also include trading pairs for BCH, ETH, ETC & XTP.

Our experience selling bitcoins on the Coinfloor Exchange (originally published December 2014)

Please note: This review is based on selling a relatively small amount of bitcoin into euro. The stats outlined in this review may not apply to larger traders. This review is part of our series of bitcoin exchanges.

As we continue to generate bitcoin from some work that we do, and our mining efforts we we conduct our mining pool reviews, we were looking for European based exchanges, and a user on r/bitcoin suggested we have a look at UK based Coinfloor.

As we’re focusing on exchanges based in Europe, or supporting SEPA (as we’re based in Ireland), Coinfloor are a brand new exchange on the block, and are a registered Bureau de Change in England. So here’s our experience getting registered, lodging bitcoin, and selling it for real money.

Coinfloor is a bitcoin exchange, that can be accessed via an API or a dedicated desktop trading application. They have a manual verification system, which requires you to give a photo id such as drivers license or passport, as well as a utility bill. Companies will require further authentication. This was stated at being two business days to verify, but it took just under four in my case. Adding the bank details was straightforward, just adding BIC and IBAN details.

Once this was done, my account was opened and I was able to deposit bitcoins into my account. These took six network confirmations to verify. The currency supports euro, sterling, dollars and zloty.

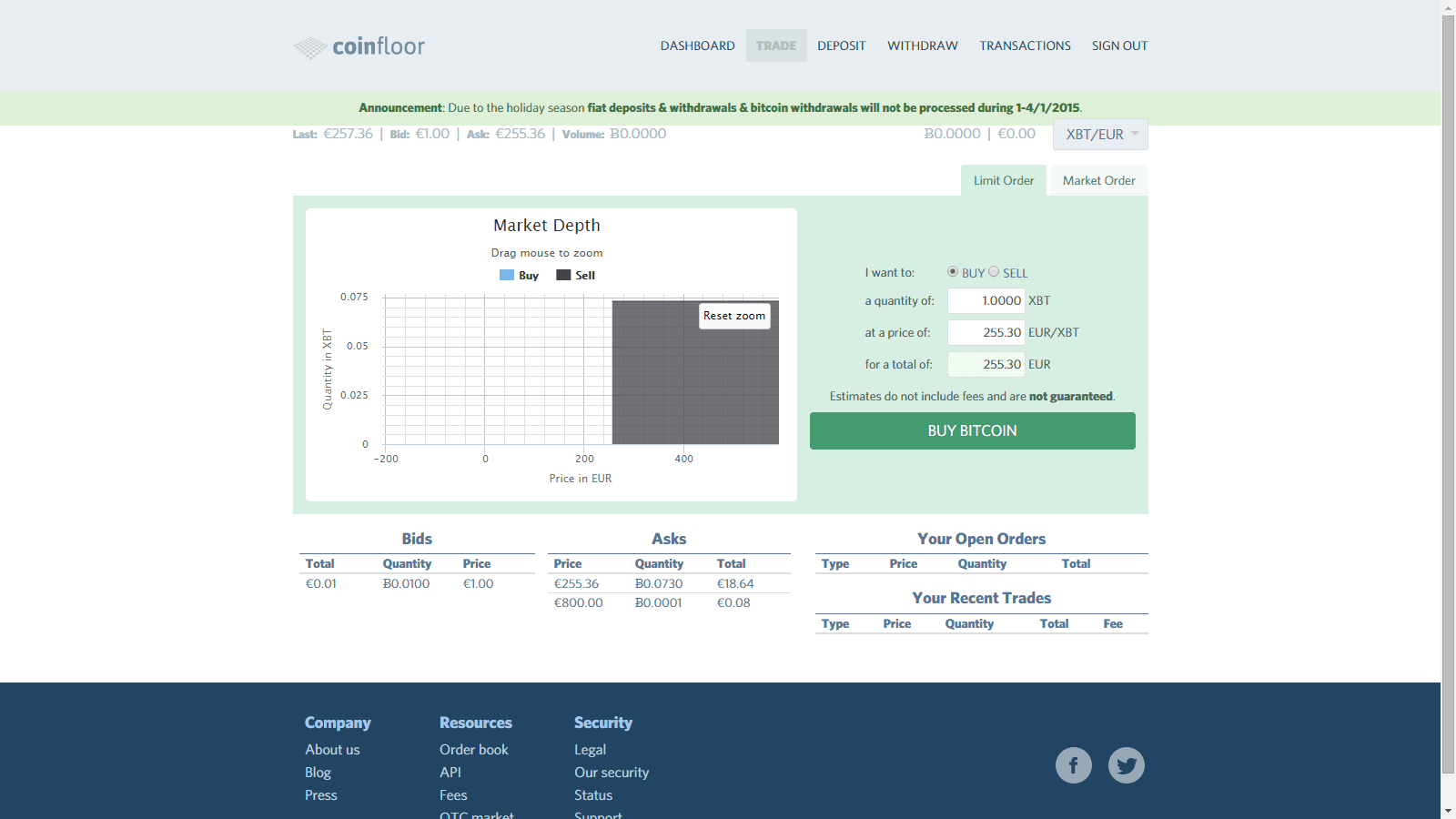

Once my bitcoin were on the exchange, I had two options. I had my coins on the limit order section for a while, but wasn’t getting there. To be honest, there seemed to be very little activity here, as there were some sell orders for €800 and buy orders for €1 which looked to me like test transactions.

Instead I cancelled these, and sold on the market order rate. My 0.12 bitcoin sold for €285 and got €34.20 (was during mid December), and I had a 0.38% fee or €0.13 deducted leaving me with 34.07. These fees depend on your volume and are outlined here.

The exchange holds funds in multi-factor cold storage, so withdrawals are only proceesed for bitcoin and fiat transactions during business hours. The fee for withdrawing into euro SEPA is €1.50 with a minimum of €5.

I had made the withdrawal request out of hours on a Monday, but by the Thursday morning the euro funds were in my account.

So Coinfloor, took a little longer than advertised to get verified, but once you do it’s a fairly intuitive exchange to use, that focuses on doing bitcoin well. It doesn’t look right now that there’s a huge amount of volume on the exchange for traders, but it seems that for buying or selling smaller amounts of bitcoin, it does what it promises. So I had a good overall experience with them, but larger traders may want to see what kind of volume is on the exchange before committing. Alternatively, you can visit our Buy Bitcoin page to get bitcoin right now.