Ready to cash out your crypto, but the question of how to withdraw crypto to my Irish bank account is bothering you? Worry not! You’re at the right destination.

Cryptocurrency withdrawal to a bank account is probably the simplest task, only when learned properly. There are a few ways, like wire transfers, ATM withdrawals, and more to make easy and safe withdrawals.

This blog post will walk you through the process of crypto to Irish bank transfers. You will also learn about Irish taxation policies on crypto, the best crypto exchanges, and everything else you need to know before making a withdrawal. Your Irish bank account is just a few steps away from enjoying crypto withdrawals.

Understanding Crypto Withdrawal to a Bank Account

Whether you adopted the crypto market at its early stage and now your 8 Bitcoin investment is worth a half million Euros or you are in the crypto market for small and fast gains, having crypto holdings is great for trading and investing – but doesn’t help a lot in increasing everyday wealth.

Cryptocurrency withdrawal to a bank account means exchanging crypto funds for fiat (government-issued currency) money. Whether you want to spend the profits you made or want to take out all funds from the market until the next bull run, the query of how to withdraw crypto to my Irish bank account might be bothering you. And it should, as doing it the right way can save money and time.

Once learned properly, you can transform your crypto into cash through a bank and enjoy easy spending.

Why Do People Cash out Crypto to a Bank Account?

People usually swap crypto for money for different reasons. The method, known as withdrawal, involves transferring crypto from your digital wallet into a bank account. The transition of cryptocurrency to a traditional banking system has various reasons. They can be financial in nature, or simply a matter of convenience.

Realizing Gains

When investors are finally in the green and have achieved their profit goals, they usually withdraw. This strategy is common among traders who accumulate crypto at lower prices and then capitalize when the market reaches highs. Once the withdrawal is made, your assets are transferred into real, spendable funds.

Liquidity Need

While crypto is valuable, it’s not quickly spendable every time for daily transactions. Once your crypto is converted into cash, it improves liquidity and now the funds are available for direct use. Normally Crypto is not spendable for everyday running expenses like bills, repairs, emergencies, or big purchases. Crypto transfers to bank accounts give a universal acceptance form to the funds. If ease in spending is what you need, crypto withdrawal to your bank account is the way!

Regulatory Compliance

The government is focused on scrutiny of crypto holdings more than ever. Hence, regulatory compliance is another important factor for crypto withdrawals. Once cryptocurrencies are converted into fiat and deposited in the bank, the funds adhere to legal and tax regulations. The procedure includes declaring crypto assets, paying taxes, legitimizing incomes, and avoiding any legal complications. This practice prevents legal troubles, and we want you to always make good gains in the market without any hurdles.

Personal and Business Transactions

Individual spending as well as business spending demand crypto withdrawal, as the amount in a bank account is much easier to spend. A normal person needs funds in the bank account for their normal spending like educational expenses, insurance repayments, and travel. Businesses might withdraw cryptocurrencies to their bank to pay salaries, office bills, or other functional costs. Since crypto is still not accepted for payments in a lot of areas, cashing it out is often important to facilitate many expenses.

How to Withdraw Crypto to My Irish Bank Account – 5 Ways

Wire Crypto to Your Bank Account Through a Centralized Exchange

The popularity of crypto increased massively in Ireland after it was registered as a virtual asset service provider (VASP) in the country in December 2022. As a result of popularity, we now have a lot of Crypto exchanges.

Cryptocurrency exchanges are online platforms that facilitate buying, selling, and trading of various cryptocurrencies. They operate as intermediaries, connecting buyers and sellers and providing a platform for them to exchange digital assets.

The simplest and easiest way to convert crypto assets into fiat and wire them to your Irish bank account is using the wire transfer feature on a centralized crypto exchange.

We recommend using PlasBit for crypto withdrawals as it is a safe and secure exchange. Withdrawing cryptocurrency from PlasBit simplifies the process, offering efficiency and convenience all in one place.

With PlasBit, the transfers are usually processed within the allotted timeframe. You can track the progress of transfers within your account. The all-in-one payment platform ensures a seamless and transparent process of exchanging cryptocurrency for traditional fiat currency.

Consider a Peer-To-Peer (P2P) Trading Platform

The peer-to-peer trading platforms are online marketplaces that allow direct buying and selling of cryptocurrencies without the need for intermediaries.

The trading platform can be a viable option considering the benefits like improved privacy, faster trades, flexibility, and the opportunity for better rates.

Nonetheless, there are some risks involved too in the platform like the risk of encountering scams or fraudulent buyers/sellers, regulatory challenges, and highly volatile prices.

Consult Fintech Solutions

Various financial platforms are out there to simplify transactions, which also include cryptocurrency withdrawals to bank accounts. It facilitates the withdrawal process as the users can find their IBANs and crypto wallets in one spot.

Normally, fintech solutions provide the facility to keep different digital assets and crypto wallets in one spot. With the platform, you can buy, sell, or spend crypto. Moreover, they may provide the payment cards.

Use Bitcoin ATMs

The process of converting cryptocurrencies into fiat currency has become more accessible and convenient with the increasing number of Bitcoin ATMs across the Republic of Ireland. It resembles the standard ATM for fiat transactions.

Bitcoin ATMs are easy to operate in practice. Like every innovation, people will have a hard time understanding the lingo and terminology initially, but the process itself is pretty simple. Once you do it once, you won’t forget.

Get a Bitcoin Debit Card:

Bitcoin Debit cards allow users to link their Bitcoin holdings to a debit card and use it for purchases and cash withdrawals at ATMs in places that take traditional debit and credit cards. It is a convenient way to access your Bitcoin funds in the real world, offering flexibility and ease of use.

Withdrawing cash from a Bitcoin ATM may take a little longer than the traditional options, however, the time difference is minuscule. The transaction may take a total of 10-20 minutes.

Keep in mind that Bitcoin debit cards may have fees for transactions, loading funds, and ATM withdrawals. Additionally, might come with limits on the amount of Bitcoin you can load onto the card and spend daily or monthly.

Best Exchanges to Wire Crypto to Irish Bank Account

PlasBit

PlasBit leads the list with its user-friendly interface and efficient wire transfer service. The exchange ensures a smooth and secure process of transferring cryptocurrency assets to your Irish bank account.

Coinbase

A popular name in the crypto world, Coinbase allows users to link their bank accounts and easily withdraw funds. It is a secure online platform for buying, selling, storing, and transferring cryptocurrency.

Kraken

Kraken is another great option to wire crypto to your Irish bank account. With competitive fees and a wide range of supported cryptocurrencies, Kraken is a popular choice among traders.

Binance

As one of the largest cryptocurrency exchanges in the world, Binance provides users with the flexibility to withdraw funds directly to their bank accounts. With low fees and a user-friendly interface, Binance offers a convenient solution for cashing out crypto.

Bitstamp

Founded in 2011, Bitstamp is one of the longest-standing cryptocurrency exchanges in the industry. It offers a seamless withdrawal process, allowing users to transfer their crypto earnings directly to their bank accounts with ease.

These exchanges streamline the process of converting your cryptocurrency into fiat currency and transferring it to your bank account in Ireland. Choose the one that best fits your needs and enjoy the convenience of wiring crypto to your bank account!

How to Withdraw Crypto to Your Irish Bank Account With PlasBit Wire Transfer

- Start by logging into your PlasBit account with your username and password to access the platform’s services.

- Navigate to the “Wire Transfers” section, where you can find information on crypto to bank transactions. This section reviews important transfer details, such as the transaction completion time (0-3 business days), a competitive fee, minimum transfer amount, and maximum transfer limit.

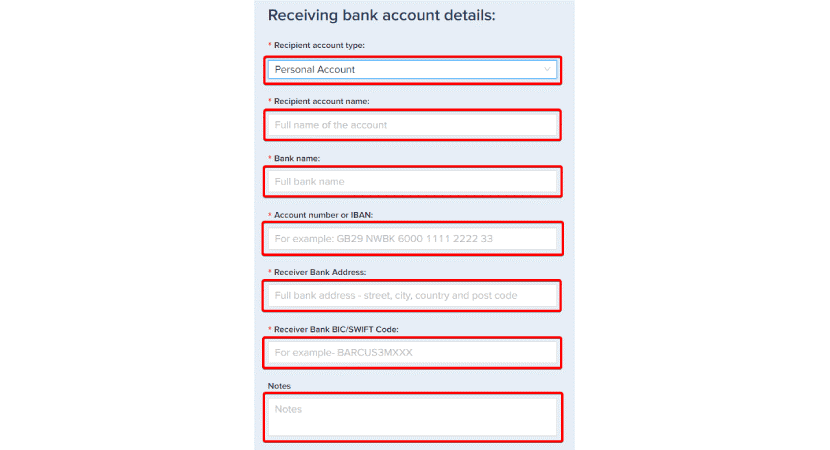

- Submit recipient bank details, including account type, name, bank name, number or IBAN, Bank address, and BIC/SWIFT code to verify payment details.

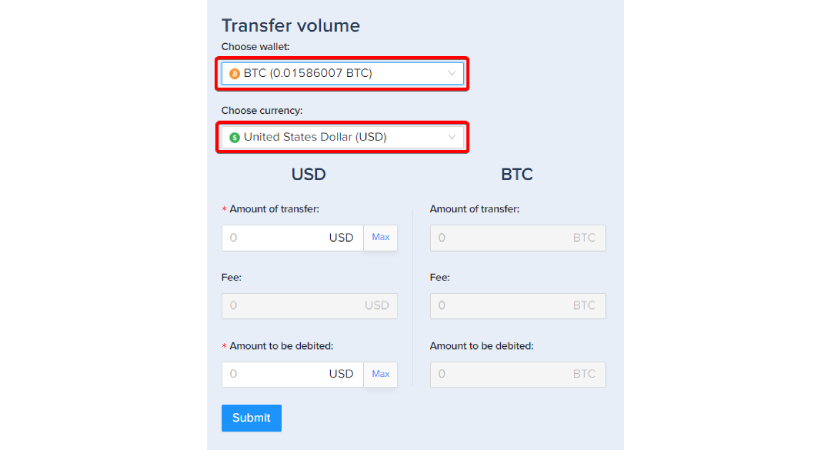

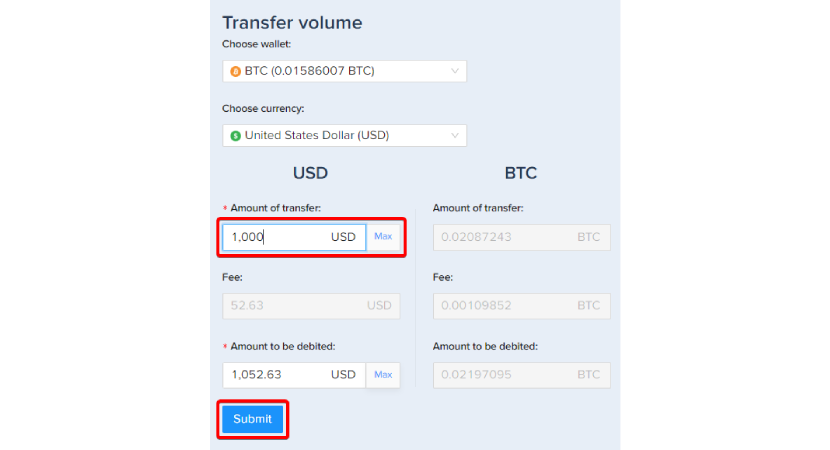

- Select the cryptocurrency you would like to convert, and the system will automatically calculate the total transfer amount and fees. Make sure your account has sufficient balance for the transaction.

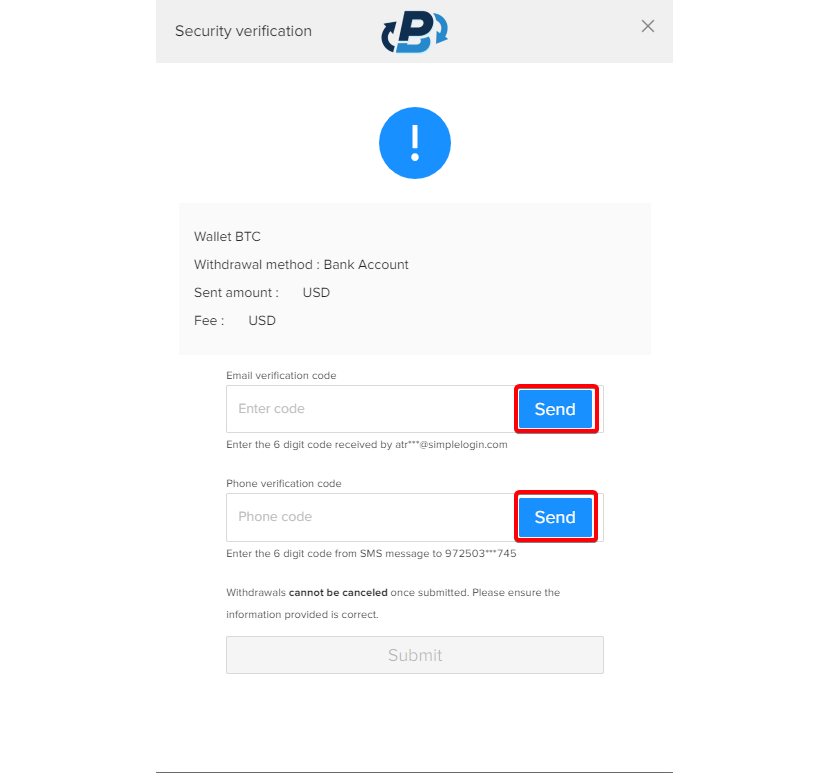

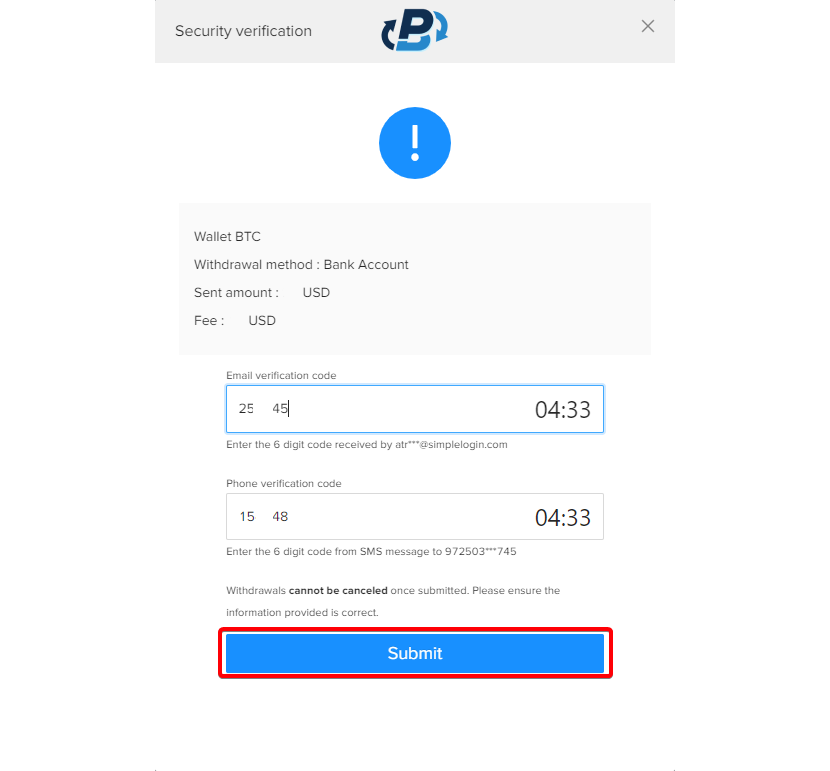

- You can increase your account security with email verification (usually activated), phone verification (optional), and enabling 2FA for an additional layer of protection.

- Verify the information and click “Submit”, receive a prompt on confirmation of the deducted crypto, and track the wire transfer’s progress in your account.

- On the next security verification page, press the “Send” button to receive the code on your phone and email.

- Submit the corresponding verification code received via phone and email and tap “submit”.

Congratulations! You have completed the process of crypto withdrawal to your bank account using the wire transfer. You can track the progress of the transfer within your account. The withdrawal will be processed within the given timeframe. Following the mentioned steps, you can efficiently withdraw your Bitcoins via PlasBit wire transfers, ensuring a transparent and seamless process of cryptocurrency exchange to traditional fiat currency.

How to Choose a Crypto Exchange

Are Crypto Exchanges Really Worth It?

If you want to buy and sell cryptocurrency, signing up on a crypto exchange is the best way to begin.

Acquiring a small amount of BTC using a local Bitcoin ATM is a convenient option, however, using an exchange makes more sense when your investment is larger and you want to acquire multiple cryptocurrencies.

The crypto exchange is not only the most legal and safest way to buy and sell cryptocurrencies but also the most convenient. Here are a few reasons why you need to sign up to a crypto exchange:

- Cryptocurrency exchanges provide the facility to buy, sell, and trade crypto online, making the crypto markets accessible from anywhere.

- Most crypto exchanges have a wide range of digital assets, offering a lot of options for investors looking to build up a mixed portfolio of digital currencies and tokens.

- Big cryptocurrency exchanges usually keep user funds in cold storage to guarantee the safety of assets.

- Global cryptocurrency exchanges normally comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) rules and financial regulations. This ensures that users are not dealing with any fraudulent company or malicious market participants.

How to Choose a Crypto Exchange – 6 Factors to Consider

If you’re looking for the best cryptocurrency exchange for you, there are a few factors you should look at. The most crucial aspects to consider are:

- Payment Methods: Almost every crypto exchange offers a few ways to fund your account or directly purchase cryptocurrencies. While most platforms support wire transfers, some allow buying crypto via debit cards, credit cards, and other online payment methods.

- Supported Assets: Bitcoin is supported on every exchange, however, if you’re looking to acquire other cryptocurrencies then check the supported assets list before selecting the exchange. Make sure it has every crypto token or currency you want to buy.

- Security: Unfortunately, hackers always keep their eyes on cryptocurrency exchanges. Cyber theft and security breaches are expected in the exchange landscape. This is why you should opt for a strong and secure exchange.

- Fees: A high fee eats your investment gains, therefore, it’s necessary to check the crypto exchange fee before signing up. Usually, crypto exchanges only charge trading and withdrawal fees, yet other transaction fees could also come in.

- Reputation: Obviously, if you’re putting your money into something, it must have a good reputation. Check customer reviews online, read the history of the exchange, and study the privacy and policies section.

- Customer Support Service: If you’re new in the world of crypto or investing, some questions might pop up in your mind, just like how to withdraw crypto to my Irish bank account did. Therefore, opting for an exchange that has excellent customer service is the best move.

Best Privacy and Security Practices for Crypto Withdrawals

When transferring funds among accounts, it’s important to be extra cautious about security and privacy to avoid potential risks. Here are some helpful tips to keep in mind:

- Only sign in to bank accounts and exchanges using secure networks to prevent unauthorized access.

- Enable 2FA on all your accounts to add an extra layer of protection.

- Carefully check addresses and URLs to avoid phishing scams.

- Avoid using public devices or unfamiliar networks to access your accounts.

- Whenever possible, use VPNs to cloak your IP address and prevent potential monitoring.

- Don’t announce withdrawals publicly or with any untrusted party.

- Keep details about your accounts and withdrawals private, and don’t share them with acquaintances.

By following the tips, you can ensure that your personal information and transactions remain secure and protected.

Cryptocurrency Taxation in Ireland

Cryptocurrencies are considered assets for Ireland tax purposes. It’s not money or currency. The capital gains are taxable at 33%. The state does not consider crypto investment by individuals as being in the nature of a trade.

Your first 1270 Euros of the capital gains are exempted from being taxed. If you receive income in the form of cryptocurrency, for instance, as payment for a job, then you will be required to pay taxes based on your income tax rates.

Additionally, you are required to pay the USC (Universal Social Charge) if your gross income exceeds €13,000. This means you will be charged a specific percentage of your whole income, including your job income and your cryptocurrency and other assets gains.

Cryptocurrency Capital Losses

We learned about gains, but it’s important to remember that investments do not always turn out that way. In case you have suffered a loss by selling crypto, which means that the price of the crypto at the selling point is less than the amount you purchased it for, then you have an allowable loss. Nevertheless, capital losses can also be beneficial as they can be used to reduce your Capital Gains Tax bill. This is possible because you are allowed to offset capital losses against the capital gains.

If the year was not good for you in the crypto market – you suffered losses and made no gains, you can use these losses in the future years to offset against the gains, which you’re likely going to earn now with bitcoinsinireland.com.

You can also transfer the allowable losses to your civil partner or spouse to offset against the capital gains they made.

However, there is an exception to the rule for assets that have been bought and sold within a period of four weeks. Generally, losses from these crypto assets could not be offset against gains, unless the gains were too made from the same kind of asset that was bought and sold within four weeks.

How Can I Avoid Crypto Taxes in Ireland?

Hold Your Crypto Assets

Hold your crypto for a long period. Simplest and easiest way. No taxes are charged on holding cryptocurrencies or transferring them among your different wallets.

Keep in mind that you are only charged with taxes when you dispose of or earn your crypto holdings.

Harvest the Losses

While nobody likes going in the red, it can have a bright side: tax benefits.

You can use crypto losses in Ireland to offset 100 percent of capital gains from crypto as well as stocks and other digital assets.

In case you experience a net loss for the year, you can use it to reduce capital gains in future tax years. As another option, transfer losses to your civil partner or spouse. This can help to minimize your tax burden and make the most of your investment opportunities.

Report the Trading Fee

Capital gains can be reduced when you report relevant fees. Trading fees (such as blockchain and exchange fees) are allowable costs that are deducted from your cryptocurrency sale prices.

Move to a Country With Lower Cryptocurrency Taxes

Although it may sound drastic, some investors choose to move to other low-tax countries. And this extreme step is sometimes really worth it, considering the charged taxes.

Many European Union citizens choose to relocate to countries such as Germany, where all profits from cryptocurrency sales that take place after a year are completely exempt from taxes.

Conclusion – Selling Bitcoin Is Possible in Ireland Using PlasBit Bank Wire

The process of crypto withdrawal to an Irish Bank account is easy and simple with the right knowledge and resources. This article guided you on various methods available, including wire transfers, peer-to-peer trading platforms, fintech solutions, and Bitcoin ATMs to help you make informed decisions that suit your specific needs and preferences.

Among all the mentioned methods, the safest way to withdraw crypto to your bank account in Ireland is using the bank wire feature on PlasBit. Nevertheless, other methods are great too in their areas.

Furthermore, it is important to understand the cryptocurrency taxation regulations in Ireland to comply with legal obligations and optimize your financial strategies. Understanding capital gains, losses, and tax-saving opportunities can help you minimize your tax liabilities and maximize your investment returns.

Now, that your question How to withdraw crypto to my Irish bank account? is answered completely in the most detailed way, go ahead and enjoy easy, safe, secure, and fast withdrawals.